New York City, New York Jan 27, 2025 (Issuewire.com) - The NYSE Amex and the SEC must take decisive action against 1847 Holdings LLC (NYSE American: EFSH) and Polished.com, Inc. (OTC: POLCQ) by invoking the clawback provision under Section 304 of the Sarbanes-Oxley Act. This provision is critical for holding executives personally accountable for fraud and mismanagement resulting in significant financial harm to shareholders. As the former largest shareholder of common stock in 1847 Holdings, I highlight the alleged fraudulent activities of these companies and their leadership, which, in my opinion, exhibit clear evidence of scienter the intent or knowledge of wrongdoing under federal securities laws.

A Salient Case of Fraudulent Activity and Mismanagement

Public filings reveal that approximately $700 million has been raised collectively by Polished.com and 1847 Holdings through IPOs, secondary offerings, and loans. Despite these significant inflows, these funds appear to have been systematically misappropriated. Many of the businesses acquired by 1847 Holdings, some of which were operational for decades, have collapsed under the management of 1847 Partners, an external management company led by Louis Bevilacqua and Ellery Roberts.

Both Polished.com and 1847 Holdings are closely connected through their shared structure and management practices. 1847 Holdings is a holding company purportedly specializing in scaling businesses and enhancing their profitability. Shareholders pay substantial management fees to this external management company, 1847 Partners, which is tasked with providing strategic oversight and leadership to drive growth and ensure success.

Polished.com, a spin-off of 1847 Holdings, operated under the same external management company, 1847 Partners, and follows similar practices. Despite claims of expertise in scaling businesses, both companies exhibit a troubling pattern where oversight by 1847 Partners seems designed not to enhance profitability but to extract value, leaving the businesses financially crippled.

This raises serious questions about how such extensive resources could disappear so quickly and whether company leadership acted deliberately to undermine these businesses for personal financial gain. Instead of fostering growth, it appears that the oversight provided by 1847 Partners was weaponized to systematically extract value and loot the very companies they were entrusted to supportdefrauding shareholders and exposing systemic failures in governance and accountability.

Polished.com Under Federal Investigation While 1847 Holdings Remains Listed

Court filings reveal that Polished.com is currently under active investigation by both the SEC and DOJ, raising significant concerns about its operations and financial practices. Polished, originally a spin-off of 1847 Holdings, shares substantial overlap in leadership and management with its former parent company. Both companies appear to employ the same alleged fraudulent playbook, characterized by financial mismanagement, the misuse of disclaimers like material weaknesses and poor internal controls, and the alleged misappropriation of funds.

The SEC investigation, disclosed in Polished.coms Form S-1 filed on February 13, 2024, is a non-public inquiry into issues uncovered in the companys Audit Committee investigation, including the restatement of financial statements for 2021 and early 2022. Court filings in Maschoff v. Polished.com Inc. confirm that these investigations are linked to allegations raised in the case, as defense costs for both the lawsuit and the regulatory inquiries are cited. Furthermore, the DOJ has initiated a parallel inquiry, underscoring the seriousness of these allegations.

Despite being delisted, Polished.coms collapse and subsequent federal investigations point to systemic issues rooted in its shared management with 1847 Holdings. While Polished faces the consequences of its alleged fraudulent activities, 1847 Holdings, the original parent company responsible for initiating these practices, remains inexplicably listed on the NYSE American. This inconsistency undermines the integrity of U.S. capital markets and highlights the urgent need for regulatory scrutiny.

A Pattern of Alleged Scienter-Driven Misconduct

The companies have demonstrated a troubling and consistent pattern of alleged misconduct, potentially reflecting deliberate intent to defraud shareholders, creditors, and employees.

In February 2024, $2.5 million was spent on four investor relations (IR) firms over just two days, February 7th and 8th for 1847 holdings. Public filings provide no evidence that these significant expenditures delivered any material benefit to the company. Instead, these disbursements raise concerns about whether they were deliberately mischaracterized to obscure their true purpose.

At the time, the company was struggling to meet its financial obligations, repeatedly delaying payments on promissory notes and incurring significant penalties. Shareholders simultaneously endured catastrophic losses, as the stock continued to decline, losing 99.999% of its value following these disbursements. This financial devastation was compounded by multiple reverse stock splits, which further eroded shareholder equity while enabling the company to artificially maintain its market listing.

Three out of these four reverse stock splits served no meaningful purpose other than artificially creating a higher price for further dilutive measures, while one was triggered by a coordinated loan default that converted debt into equity. This debt conversion flooded the market with shares, crushed the stock price, and exacerbated shareholder losses. These actions reflect a broader strategy of financial manipulation, seemingly designed to preserve managements control while devastating retail investors.

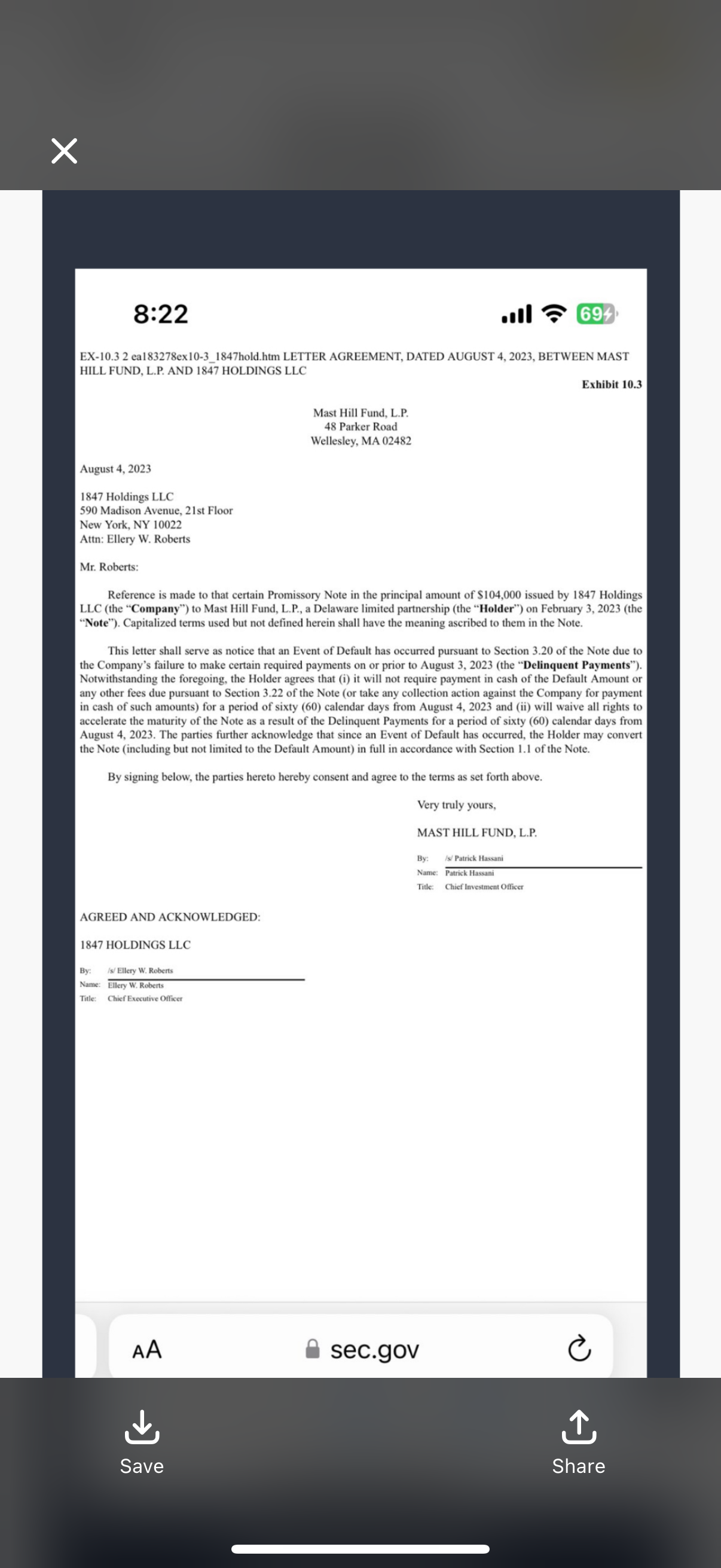

Another troubling issue occurred on August 4, 2023, when two separate lenders defaulted 1847 Holdings on the same day, using identical language in their filingsstrongly suggesting a pre-planned default. These defaults followed consecutive cash raises that were intended to pay off the promissory notes. The resulting debt-to-equity conversions caused significant dilution, ultimately forcing the company into a reverse stock split to address its dangerously low share price.

Weaponization of Financial Disclaimers

Leadership at 1847 Holdings and Polished.com appears to have strategically exploited disclaimers such as material weaknesses in financial reporting and poor internal controls to obscure accountability. These disclaimers, typically intended to signal transparency, were frequently invoked at the subsidiary level, where significant sums of money seem to vanish without adequate explanation.

Rather than addressing these deficiencies, leadership has seemingly used these disclaimers as a shield to deflect liability while enabling the alleged misappropriation of funds. This deliberate lack of oversight has created an environment in which financial mismanagement thrives, further raising concerns about the leaderships intent and motives.

Where did the money go?

Despite raising over $400 million over three years, Polished.com ultimately declared bankruptcy, raising serious questions about how such staggering resources could be mismanaged so catastrophically. The companys access to unprecedented capital was intended to fuel growth and operational success, yet instead, the funds seem to have been squandered or diverted. With no clear accounting for the disappearance of such a substantial sum, stakeholders are left questioning whether leadership engaged in deliberate financial mismanagement, reckless spending, or outright misappropriation of funds. This failure highlights systemic issues in oversight and governance, particularly given Polished.coms shared leadership and operational practices with its original parent company, 1847 Holdings.

Anti-Takeover Povision: A Poison Pill

The companys most recent proxy filing proposed an anti-takeover provision, or poison pill, which increases authorized shares to dilute voting power. This measure effectively ensures that management retains control, even in the event of offers favorable to shareholders. Such a provision demonstrates a blatant disregard for accountability and highlights leaderships intent to entrench itself further while avoiding reform.

Regulatory and Legal Concerns

The refusal to conduct a meaningful forensic audit, despite repeated calls from shareholders, underscores concerns of deliberate concealment. While leadership has claimed that audits were completed, their reliance on disclaimers of poor internal controls and material weaknesses at the subsidiary level renders such audits meaningless. This evasive behavior raises critical questions about whether executives acted with the intent to suppress transparency and obscure fraudulent activities.

Compounding these issues is the glaring conflict of interest posed by Louis Bevilacqua, who serves as both legal counsel and a preferred shareholder of 1847 partners. His financial gains, tied directly to the companys alleged fraudulent financial performance, create a clear incentive to obstruct independent scrutiny. This conflict of interest became evident when, as the largest shareholder of 1847 holdings, holding over 10% of the companys stock, I requested a forensic audit to ensure transparency and accountability.

Rather than addressing my legitimate concerns, Bevilacqua characterized my request as an attempt to harass the company and responded with threats of legal action against meactions that are both unfathomable and deeply troubling. It is inconceivable for the largest shareholder, with a vested interest in the companys success, to be treated with such hostility for merely seeking transparency. This behavior further underscores the pervasive governance failures and raises serious questions about whether the companys leadership was deliberately suppressing oversight to protect its own interests.

The Case for the Clawback Provision

The invocation of the clawback provision under the Sarbanes-Oxley Act is critical to recovering funds misappropriated through fraudulent activities, protecting future investors from similar schemes, and reinforcing the principle that corporate fraud will not be tolerated.

Conclusion

The alleged fraudulent activities of 1847 Holdings and Polished.com highlight a systemic failure in corporate governance and demand immediate regulatory action. The SEC and NYSE must investigate, invoke the clawback provision, and hold these executives accountable for their actions to restore trust in U.S. capital markets.

Disclaimer: This press release contains statements based on publicly available information, personal opinions, and interpretations of regulatory filings and events. While every effort has been made to ensure accuracy, inadvertent inaccuracies may exist. Readers are encouraged to conduct their own due diligence and consult professional advisors before making investment or legal decisions. The views expressed here are solely those of the author and do not necessarily reflect the views of any organization or institution.

Contact:

Matt Miller

914-306-4771

Source :1847 holdings EFSH and Polished POLCQ

This article was originally published by IssueWire. Read the original article here.